Regardless of where you are in life, budgeting is important for understanding and directing where your money goes. The right budget can help you achieve your financial goals and improve your quality of life. This is especially true if, like me, you’re raising a family that depends on you.

Creating a realistic budget strategy is a crucial part of better managing your finances. Fortunately, even if you have zero budgeting experience, managing your money doesn’t have to be complicated. I’m sharing 15 basic budgeting tips that can help you build an effective budget strategy.

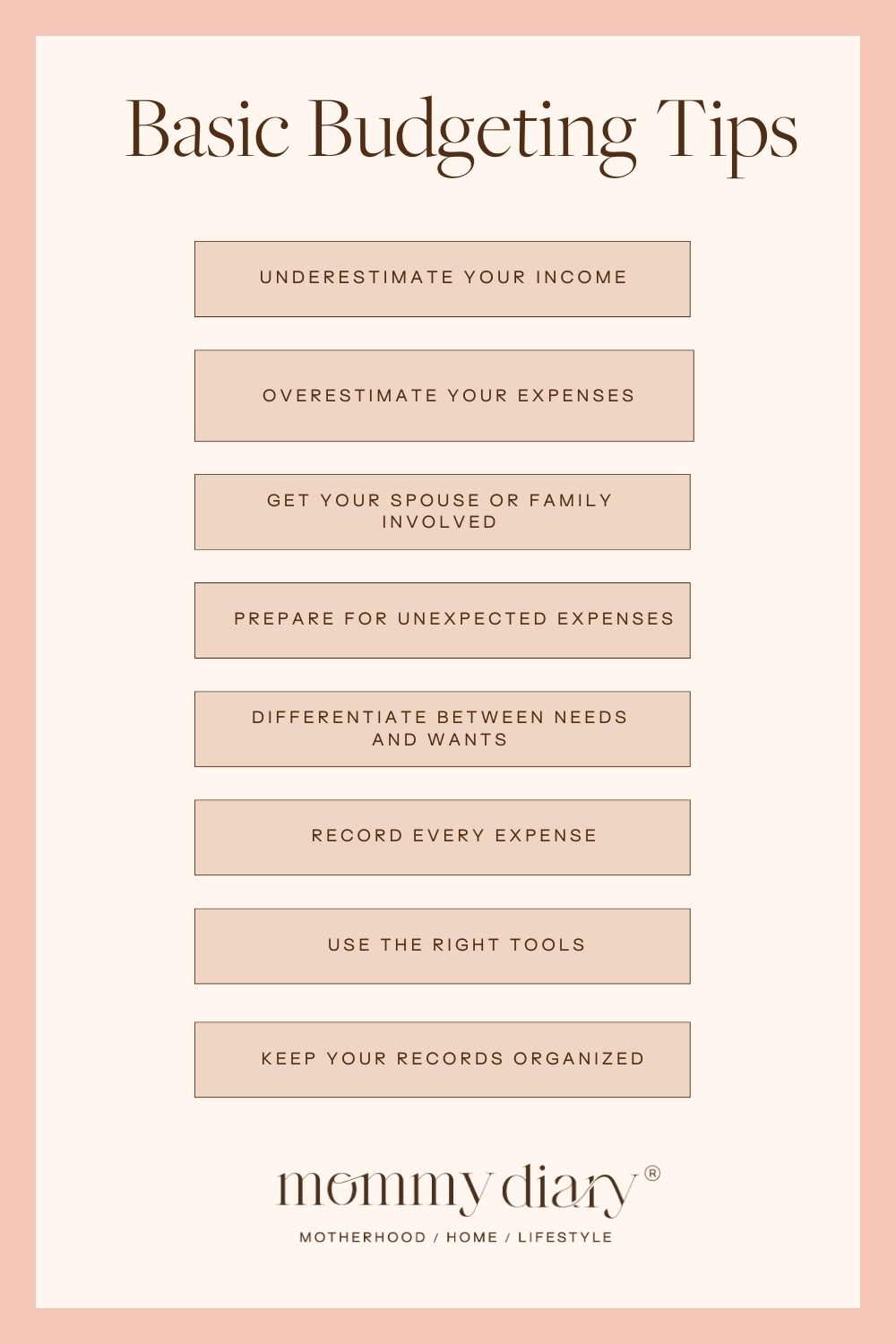

15 Basic Budgeting Tips

Underestimate your income.

Underestimating your income when creating a budget is an easy way to set yourself up for success. When you underestimate the amount of money you earn each month, you’re more likely to underspend and be left with a surplus.

Overestimate your expenses.

Along the same lines as underestimating your income, you should also overestimate your expenses. It’s impossible to predict exactly how much you will spend each month. Overestimating the amount ensures that there won’t be any surprises.

Get your spouse or family involved.

Getting someone else involved in your budgeting plans is a great way to hold yourself accountable. Ideally, you will involve someone who will help you stick to your goals, like your spouse or family members.

Prepare for unexpected expenses.

No matter how much time and effort you put into planning, sometimes we’re slapped with an unexpected expense. These expenses, like a trip to the emergency room or home repairs, are hard to predict. For this reason, it’s important to include an emergency fund in your budget. How much you want to set aside for your emergency savings is up to you.

Differentiate between needs and wants.

The ability to differentiate between needs and wants is crucial to money management. Needs are anything that play an essential role in your physical, mental, and financial well-being. Expenses like food, your mortgage, utilities, and debt repayment are needs. On the other hand, non-essential things, or things that you can live without, are considered wants.

Being able to separate your needs from your wants allows you to follow the popular 50/30/20 budgeting rule. Essentially, 50 percent of your income goes toward essential things, 30 percent can be spent on your wants, and 20 percent goes into savings. I’ll explore some other budgeting methods later in this post.

Record every expense.

To effectively create and stick to a budget, you need to record every expense. That means writing down or keeping track of every dollar you spend and what you spent it on. People will often overlook minor expenses, but those small charges add up.

Use the right tools.

The right budgeting tool can help set you up for success. Budgeting apps are great for tracking your spending and keeping your financial information organized.

Best Budgeting Apps

Mint

Mint is a mega-popular, top-rated FREE app with a bunch of budgeting tools. The app syncs your checking and savings accounts, credit cards, loans, investments, and bills, then tracks your expenses. It places your expenses in budget categories, which you can personalize. You can also set limits for each category and Mint will notify you when you’re getting close to your limit.

The Mint app is also helpful for paying off debt, saving more money, and tracking financial goals.

YNAB

YNAB, an acronym for You Need A Budget, is another top-rated app that helps users plan ahead for their finances. Rather than tracking your past transactions, YNAB uses the zero-based budgeting system to allocate every dollar you bring in.

YNAB lets you sync your checking and savings accounts, credit cards, and loans. It costs $14.99 per month or $99 per year.

Goodbudget

Goodbudget is a useful app for planning your finances. It utilizes the envelope budgeting technique by allocating your monthly income to specific spending categories.

Unlike the other two apps, Goodbudget doesn’t connect to your bank accounts. Instead, you manually add your account balances, as well as debts, income, and cash amounts.

With the free version of Goodbudget, you get one account, two devices, and a limited number of envelopes. The paid version, Goodbudget Plus, gives you unlimited envelopes and accounts, up to five devices, and more. Goodbudget Plus is $8 per month or $70 per year.

Keep your records organized.

Keeping your financial records, like bills and receipts, organized is important. You never know when you might need to look back at a bill to dispute it or refer to a receipt for tax purposes. You can use physical files and sort your records appropriately, or you can file everything electronically.

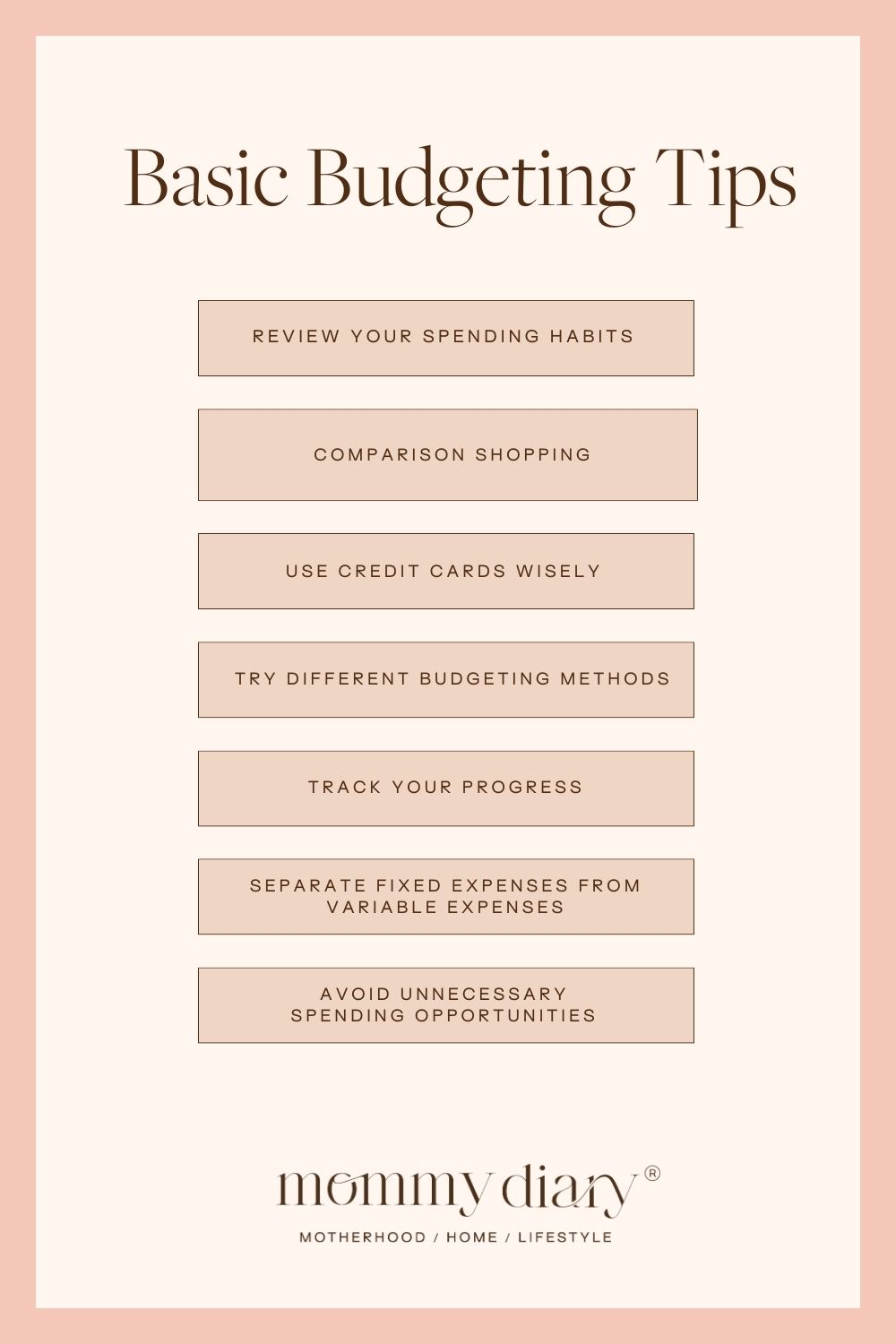

Review your spending habits.

Use this as an opportunity to review your spending habits. Are there any expenses you can reduce or eliminate? Perhaps you’re paying for streaming services you’re not using or you buy your lunch every day rather than packing a lunch. Take the time to examine where your money is going and make adjustments where you can.

Comparison shopping.

Comparison shopping is a great way to save money. Essentially, you compare the products you buy and the services you use, with others that are available. This way, you can make more informed purchase decisions and potentially reduce your expenses.

Bear in mind, cheaper isn’t always better. An important part of comparison shopping is looking at the product or service as a whole to ensure you’re getting the best deal.

Use credit cards wisely.

Credit cards can be a great financial tool but they should be used with caution. Limit the number of credit cards you use or get rid of them entirely. Even if you’ve been on point about paying off your credit card balance every month, the amount of interest spent on credit card transactions has the potential to forever leave you trying to get ahead.

Try different budgeting methods.

To be successful, you need to create a budget that fits your life, values, and goals. The right budget method should make your life easier, help you to move forward, and push you toward your financial goals.

Different Budgeting Methods

Zero-Based Budget

With the zero-based budget method, you’re allocating every dollar earned. This method was popularized by Dave Ramsey. As per the tagline for this method, you want to “give every dollar a job.” However, that doesn’t mean you’re literally spending every dollar, it means that every dollar is accounted for.

Some of your money will be assigned to bills like rent and utilities, while others are assigned to your retirement or emergency fund. Some of your income will be put into a savings account, 401K, Roth IRA, etc.

And some portion of your money you’re giving the job of paying your electric bill or mortgage and others you are giving it the job of funding your retirement or emergency fund. Every dollar is accounted for, which means that once every dollar is put into a category, you are at zero.

Envelope System Or Cash-Only Budget Method

The envelope system, also known as “envelope budgeting” or “cash-only budgeting” requires you to use only cash for all of your transactions, no debit card or credit card allowed.

With this method, your money is allocated to separate categories. You then put cash into envelopes that are labeled for each category. It’s an easy way to keep track of your spending and avoid going over your budget.

For example, if your rent is $1,200, you would withdraw $1,200 in cash from your bank account and place it into the envelope you labeled “rent.”

The “No” Budget

Here’s a great budget method for anyone who really doesn’t like budgeting. It doesn’t require any work and you don’t have to track your expenses. Instead, you simply automate your savings to make sure there is enough money in your checking account to cover all of your bills. You can make these even easier by automating bill payments whenever possible.

The 60% Solution

The 60% Solution is a budgeting method popularized by former editor-in-chief of MSN Money, Richard Jenkins.

With this method, 60% of your income is used for “committed expenses” like your mortgage, insurance, car payments, food, etc. All of your bills that need to be paid each month are included in this category.

The remaining 40% is divided into 4 categories, with 10% going to each:

- Retirement

- Long-term savings

- Short-term savings

- Fun money

Track your progress.

Budgeting requires continuous effort to be successful. Tracking your progress allows you to see how far you’ve come, as well as which goals you would still like to achieve. It also allows you to make changes, as needed, to your budget method so that it suits your current lifestyle and financial goals.

Separate fixed expenses from variable expenses.

Typically, your spending will fall into two categories: fixed expenses and variable expenses. Understanding the difference can help you figure out what your financial priorities are and cut back on unnecessary spending.

Fixed expenses are usually around the same each month. These include things like rent, insurance, and your cellphone bill.

Variable expenses are costs that you have more control over. These kinds of expenses fluctuate each month and include things like entertainment, groceries, clothing, etc.

Avoid unnecessary spending opportunities.

Unnecessary spending should be avoided as much as possible when you’re on a budget. Whether you’re saving for retirement or trying to pay off student loans, those things should take priority over unnecessary costs like entertainment and dining out. While you shouldn’t make yourself miserable to save money, you should prioritize saving more and spending less.

Whether you’re a beginner or a financial expert, these basic budgeting tips can significantly improve your quality of life.

Financial stress can take a major toll on your quality of life. The easiest way to overcome financial stress is to create and stick to a budget. I hope these basic budgeting tips can help you feel more in control of your financial situation, and take some of the burden off your shoulders.

You can find more valuable tips and tricks, on my blog, my Instagram, and my podcast.